Bitcoin Halving 2024: What to Expect

Bitcoin halving is a highly anticipated crypto market event influencing the cryptocurrency’s price and the crypto market in general. In this text, we will discuss the process of Bitcoin halving and what traders and investors can expect after the fourth halving in 2024.

What Is Halving in Bitcoin

Bitcoin is one of the most secure, decentralized, and resistant cryptocurrencies since it relies on a Proof of Work (PoW) consensus mechanism and miners confirming transactions. Miners' work is crucial for the network, so they get rewards for every minted block. One block appears on average every ten minutes, and new Bitcoins are minted every ten minutes as a mining reward.

Unlike fiat currencies, Bitcoin has a fixed supply of 21,000,000,000, and its purchasing power, in a long-term perspective, grows because of circulating supply control. As digital gold, Bitcoin exposes scarcity, and its supply decreases to spike demand and price.

To decrease supply and increase price, the mining reward reduces by 50% once 210,000 blocks are minted. The process is known as halving. There were already three Bitcoin halvings in 2012, 2016, and 2020. In 2023 the mining reward per block is 6.25 BTC; after the fourth halving in 2024, it will drop to 3.125 BTC.

When Is Bitcoin Halving 2024

Bitcoin halving takes place quarterly once one more 210,000 have been minted. Since the time of the creation of one block may fluctuate, but on average, it takes 10 minutes, the particular halving date isn’t set. The estimated Bitcoin halving will occur in April-May 2024.

How Does Bitcoin Halving Influence the Bitcoin Price?

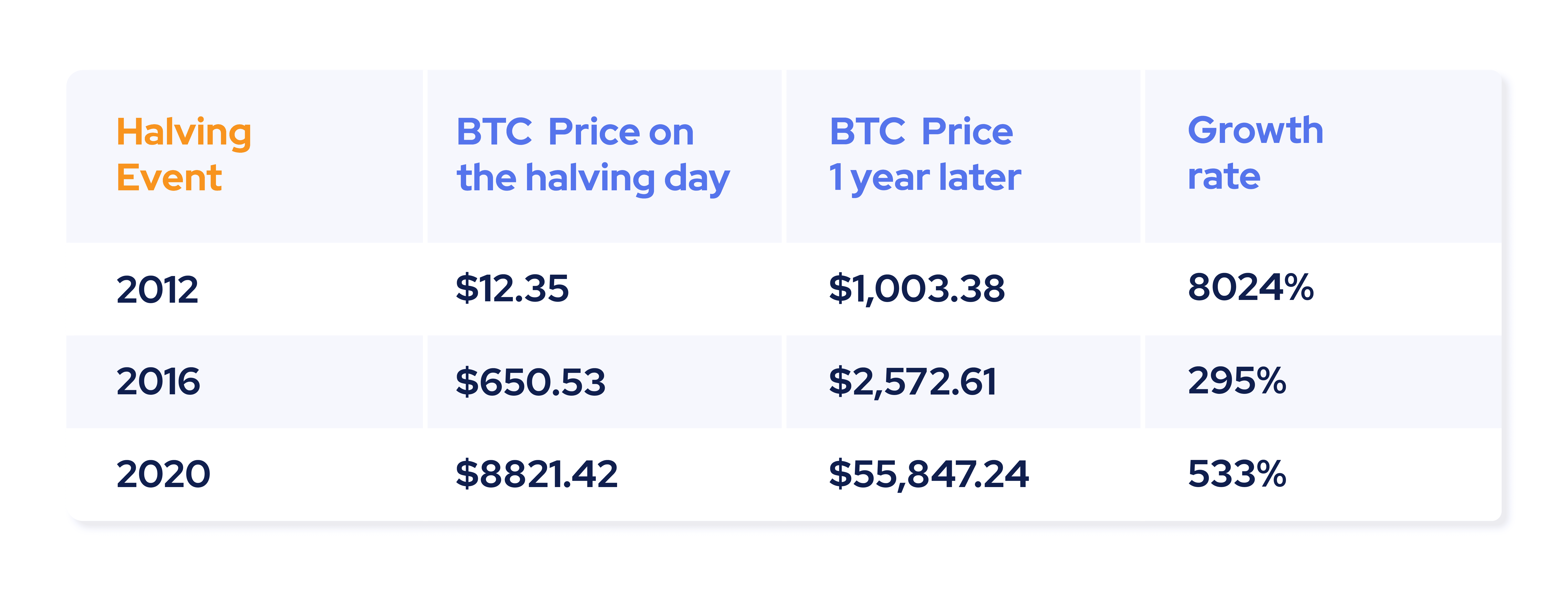

Bitcoin halving is highly anticipated by the crypto community since it previously led to BTC price skyrocketing. Let's take a look at three Bitcoin halvings in numbers.

Obviously, the halving itself isn’t the only reason extremely increasing the cryptocurrency price, but it usually goes before the bull running. The BTC price is also determined by market demand, investors sentiment, adoption rates, regulatory developments, technological advancements, and macroeconomic conditions.

The traditional law of supply and demand states decreasing supply leads to increasing demand and price, so some consider Bitcoin halving 2024 will become the next game-changing event for the cryptocurrency and the whole crypto market, making BTC hit a new all-time high of $100,000.

The recent crash in the traditional financial system also determines bullish sentiment, as every failure makes people turn to alternatives that cryptocurrencies currently are.

However, the increasing number of regulations, tax policies, and government control over personal data, private keys, and seed phrases in the cryptocurrency market makes it less decentralized and less appealing to individuals seeking alternatives to traditional banks. So some predict the BTC price will drop to an extreme $10,000 lately after halving.

How Does Bitcoin Halving Influence Altcoins?

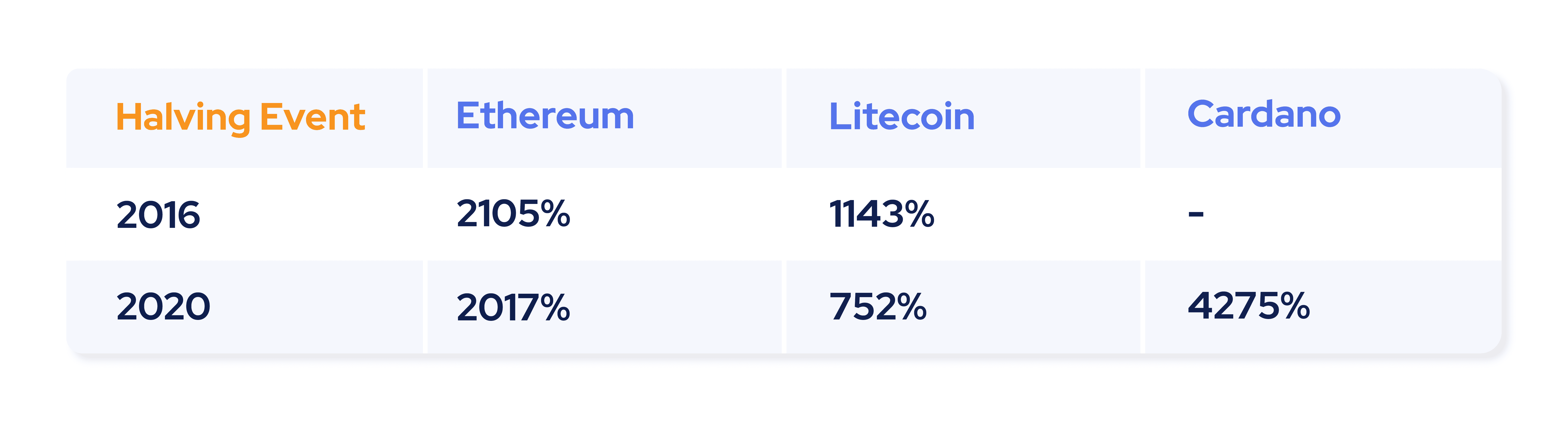

While halving, we need to consider what happens to the rest of the crypto market. So let’s take a look at how prices have grown one year after halving events for Ethereum, Litecoin, and Cardano.

The trend remains the same, and currencies show extreme growth.

How Does Bitcoin Halving Influence Mining?

Since the mining reward will reduce twice, for retail miners, Bitcoin mining may become unprofitable, making them consolidate with institutional miners or exit the market. Both events negatively impact the cryptocurrency since only a roughly few large miners will control transactions driving the centralization of the network. In the end, this will result in reduced security and increased vulnerability of the network.

Considering the PoW consensus mechanism consumes a vast of energy, miners will likely choose energy-efficient equipment to cover their costs. It is a great time for green energy solutions such as wind, solar, and hydro energy, as they are the cheapest resources.

With mining rewards decreasing, miners will take a look at altcoins with better mining reward propositions and more energy-efficient consensus mechanisms. It can be the second large cryptocurrency Ethereum reduced its energy consumption by 99.95% after shifting to a Proof of Stake (PoS) consensus mechanism in September 2022.

Bottom Line

The Bitcoin halving 2024 may potentially present a promising opportunity for crypto traders and investors to profit from increased prices and bullish market sentiment. Since the recent drop in the crypto market, Bitcoin and altcoins have become available for small investors, and the bearish market is a time to buy crypto and be patient.

Be prepared and buy Bitcoin, Ethereum, Litecoin, Cardano, and other cryptos at SpectroCoin.