Introducing Crypto Loans at SpectroCoin

Today, we are thrilled to announce that SpectroCoin now offers crypto-backed lending services. As we continue to expand on products and services aimed at the crypto community, we are excited to be taking over the Bankera Loans project and fitting it into the SpectroCoin family. Starting now, SpectroCoin clients can leverage their cryptocurrency, without having to sell it, in return for a loan. To help you get acquainted with Crypto Loans, we have prepared a thorough rundown of what cryptocurrency lending is and how our lending solution works.

What is cryptocurrency lending?

Cryptocurrency lending enables crypto holders to gain quick access to financing without having to sell their cryptocurrencies and lose on the upside potential of their digital assets. Instead, cryptocurrency owners can put their cryptos to work by placing them as collateral and getting credit at SpectroCoin Crypto Loans. The cryptocurrencies are returned upon the full repayment of the loan.

The most efficient solution for crypto-backed financing

At SpectroCoin, we provide flexible and accessible crypto loans to individual and business clients globally. We offer a straightforward signup procedure, a variety of loan packages, flexible scheduling opportunities, and a swift approval process.

The lowest loan minimum on the market

Our entry limit, which stands at 25 EUR, is the lowest on the market. Since clients going for smaller loans receive the same support and loan management services as those taking larger ones, the most popular lenders typically offer loan minimums starting only at around 500 EUR. By offering a loan minimum of 25 EUR, we can offer services to users willing to try out our crypto lending services, as well as clients looking for microfinancing.

Very high LTV ratio

Another upside to our crypto loans is that we provide one of the highest LTV (Loan-to-Value) ratios on the market ranging from 25% up to 75%. The industry average stands at around 50%.

Multi-currency support

At SpectroCoin Crypto Loans, we ensure that our clients can deposit or withdraw their funds in a way that is most convenient to them. We support withdrawals for fiat (Euros) as well as for cryptocurrencies. The list includes Bitcoin (BTC), Ether (ETH), Tether (USDT), NEM (XEM), or Dash (DASH).

When it comes to collateral options, we support the following cryptocurrencies as deposit options: Bitcoin (BTC), Ether (ETH), NEM (XEM), and Dash (DASH). We are planning on rolling out more withdrawal as well as collateral options soon.

Flexible loan repayment

As a standard practice, at SpectroCoin Crypto Loans, we issue all credit lines for a year. However, you are free to repay the credit any time before the loan matures without incurring a penalty of any sorts. Finally, if you believe that missing a deadline is a possibility, you can always extend it for another year. However, with each extension of the contract, you are increasing the interest rate on the loan.

Lower interest rates for Banker token holders

All Banker (BNK) token holders can take advantage of lower interest rates by using BNK as currency for interest payments.

24/7 customer support

Since we have been operating in the financial sector for over 7 years, we know that a reliable customer support service is critical. To ensure a seamless experience for each of our customers, we provide customer support services 24/7.

Crypto loans for cryptocurrency holders of all levels

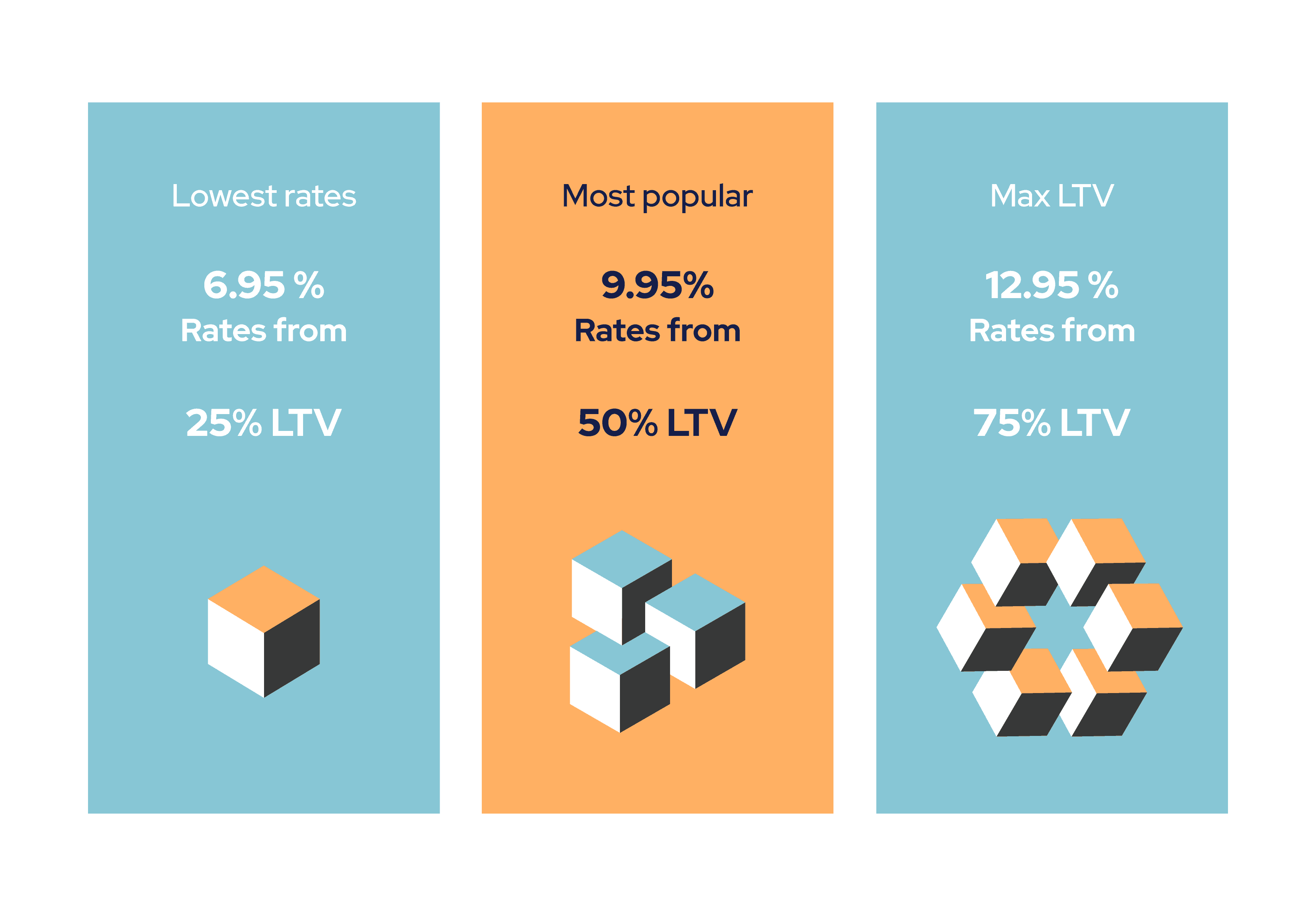

At the moment, our crypto loans service offers three distinct loan packages catering to our clients’ varying needs and capabilities. Each package provides a unique combination of an LTV ratio, interest rates, and collateral options.

The lowest rates

We designed the Lowest Rates package for risk-averse clients. This is the safest borrowing option offering 25% LTV and the smallest loan rates.

The most popular

The Most Popular loan package offers a 50% LTV and is a balanced option between the loan size and the rates.

High loan-to-value ratios

For those who are looking for the biggest credit available with their crypto collateral, we have comprised a Max LTV package featuring LTV of 75%. Max LTV package is suited for risk-tolerant clients who prioritise getting a high loan value for their collateral and can react to alerts swiftly, in case the value of the collateral falls.

Visit SpectroCoin Loans and get a crypto-backed loan today!

If you have further questions regarding our crypto lending services, please contact us at [email protected] or via LiveChat option available on the SpectroCoin website.