Margin Calls and LTV

At SpectroCoin, you can use your cryptocurrency holdings as collateral to back a crypto loan. We tailor to the needs of each client. Get a crypto credit as low as 25 EUR or as high as 1 million EUR with competitive loan rates. Another benefit of crypto-backed loans at SpectroCoin is that we offer a very high loan-to-value (LTV). But what even is an LTV and what to do when it is too high? Find the answers in this SpectroCoin blog.

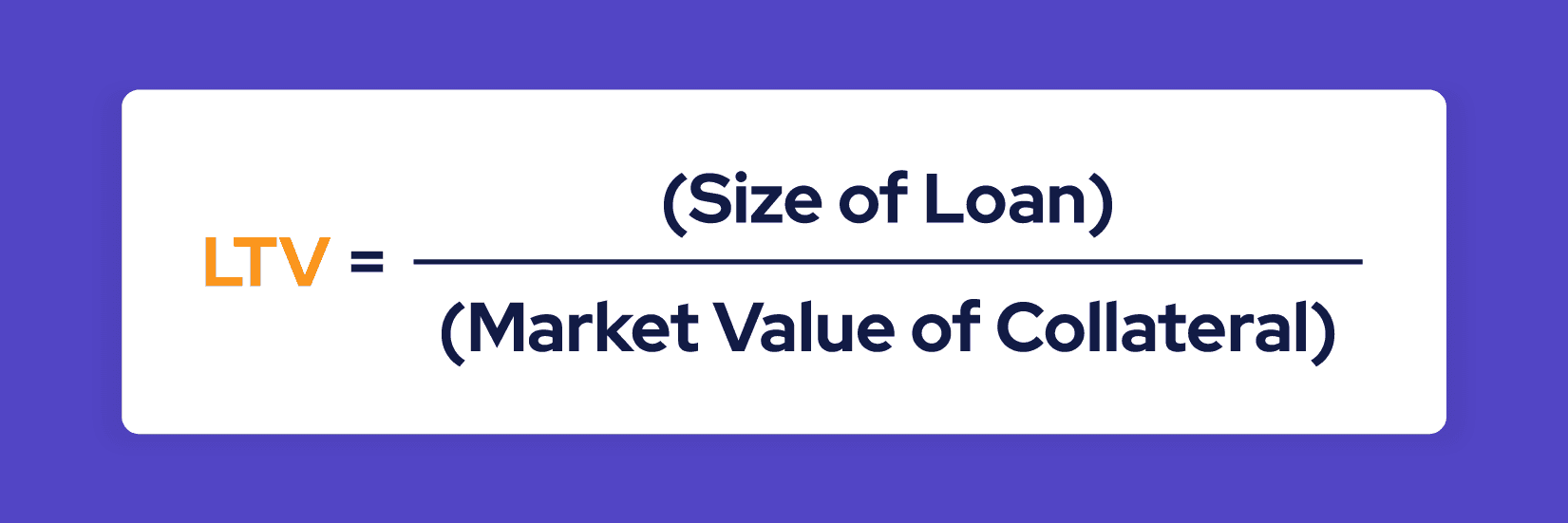

Loan-to-Value (LTV)

Traditionally your credit score is used to determine if you are eligible for a loan. The higher your credit score, the lower the risk for the lender. Asset-backed loans remove the need for a credit score. Crypto is perfect collateral because there is no need to verify the borrower’s creditworthiness. But this does not eliminate all risk for the lender.

In asset-backed lending, it is common to secure your loan with higher-value collateral. And this is where the LTV ratio comes in. The LTV ratio is the rate between the loan size and collateral value, expressed as a percentage.

So, for example, if you take a loan of 1,000 EUR and pledge 0.2 of hypothetical crypto called COIN, which is worth 2,000 EUR at the time, as collateral, your LTV is 1,000 EUR/2,000 EUR = 50%.

Lower LTV means that if the market falls, your crypto is not likely to be liquidated to secure a lender’s investment. In case your collateral market value falls, your LTV grows. If your collateral value drops significantly and LTV reaches 80%, you will get an email notification with instructions to check your LTV.

Respond to Margin Calls

If your collateral value dropped significantly, there are few options for you:

Option no. 1 – Do nothing. SpectroCoin will take care of your loan. In a pessimistic scenario, when the market value drops further and LTV goes above 90%

- If you have enough funds in your wallets, they will be used to repay a part of your loan.

- If you do not have enough funds in your wallets, your collateral will be used for repayment.

When the market value goes up and the LTV ratio goes down, your collateral and fund in the wallets will stay untouched.

Option no. 2 – Choose how you would like to control the risk.

- Make a partial repayment of the remaining loan amount. Thereby, you will decrease the LTV.

- Add a certain amount of collateral currency to the Collateral Wallet balance and set the LTV back to the recommended LTV to prevent a potential liquidation.

As soon as the market value goes up and your LTV becomes lower than the recommended LTV, you will be able to withdraw a part of your collateral and use it for other loans, partial repayments or anything else.

Status Check

To check the status of your Loan and Collateral at SpectroCoin, go to Loans, and you will see a list of your crypto-backed loans. Next to each loan, you will see a colour-coded LTV, making it easy to understand which ones are at risk. If you see that your loan is at risk, click on “View” next to your loan.

At your Collateral wallet, you will find information about your Collateral Currency, Amount, EUR value, current LTV and recommended LTV (initial LTC of your loan).

More information

For more information regarding SpectroCoin loans please refer to: General information about crypto loans. Here How to get a crypto loan at SpectroCoin? Here What is collateral and what currencies can I use for it? Here We hope this blog post was helpful. For more blogs be sure to head over to the SpectroCoin blog. If you have any questions about SpectroCoin, don’t hesitate to contact our customer support through the LiveChat bubble available on our website or drop an email at [email protected]